Rohan, a diligent investor, was all smiles at the end of 2007. His portfolio, heavy with equity mutual funds tracking the Nifty, was flying high. He felt invincible. Then came the Global Financial Crisis of 2008. In a matter of months, the Nifty plummeted, taking Rohan’s portfolio value with it. The experience was a painful lesson in market volatility. He watched as his investment, meant for his future, was cut down by global panic.

Fast forward to 2020. As the world reeled from the COVID-19 pandemic, stock markets crashed once again. But this time, Rohan was calm. While his equity funds fell, a different part of his portfolio held steady, cushioning the blow and helping him sleep soundly. That steady asset was gold.

This simple story illustrates a timeless truth: an investment strategy built on a single asset class is a gamble. True resilience comes from a partnership, and for a portfolio built on Nifty-based mutual funds, gold is the ideal partner.

The Performance Duality: A Tale of Two Investments

Investors often weigh equity mutual funds against gold. While Nifty aims for growth, gold offers stability, which is crucial for a truly balanced portfolio.

- Nifty for Long-Term Growth: Driven by India’s economic engine and corporate earnings, Nifty has provided strong returns over long periods. It is the engine of wealth creation.

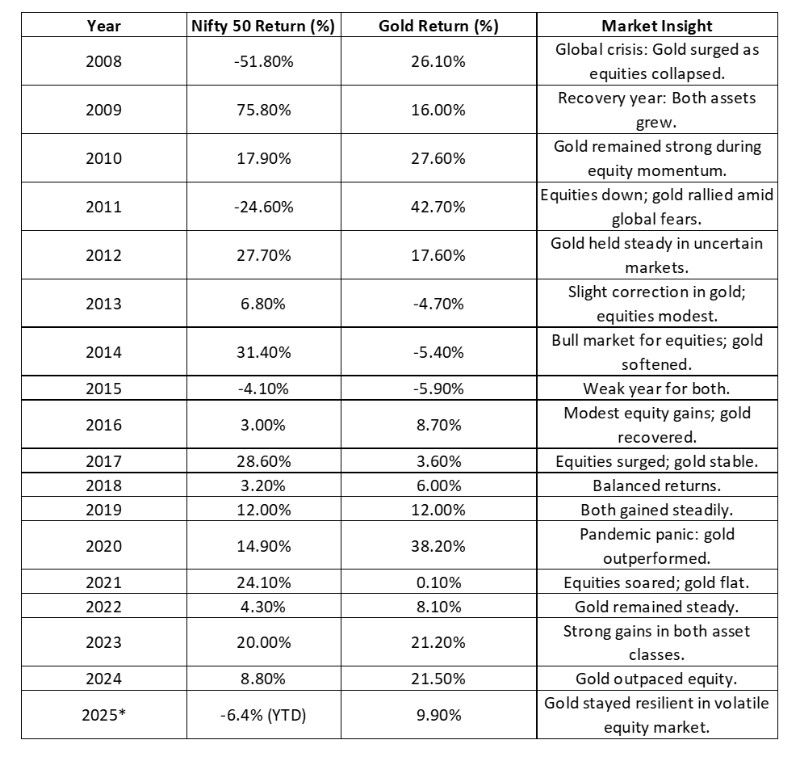

- Gold as a “Safe Haven”: Gold’s value shines in moments of crisis. As seen in 2008 and again in 2020, when fear gripped the markets, gold prices surged, acting as a vital hedge. This inverse relationship highlights gold’s role as a portfolio diversifier, helping balance overall risk.

Let’s look at a simple example. Imagine two investors, Rohan and Sunita, in early 2020. Both invested ₹1 lakh. Rohan put all his money in a Nifty 50 equity mutual fund. Sunita, following a diversified approach, put ₹90,000 in the same Nifty fund and ₹10,000 in a Gold Mutual Fund. When the market crashed in March 2020, Rohan’s entire portfolio suffered. Sunita’s Nifty fund also fell, but the gains in her gold fund softened the overall loss, proving the power of diversification.

Why Gold is an Essential Component

Beyond its traditional use as jewelry, gold’s modern investment value lies in its unique financial properties:

- Inflation Hedge: Inflation is the silent thief of purchasing power. Historically, gold has held its value when currency depreciates, providing a reliable shield against rising prices.

- Diversification: The low correlation between gold and equity mutual funds is its most significant benefit. It’s a non-emotional asset that moves on its own terms, reducing overall portfolio volatility.

- Safe Haven: When global or geopolitical uncertainties arise, investors flock to gold. This consistent demand ensures its stability, providing a clear benefit during uncertain times.

- Convenience: The days of buying and storing physical gold are long gone. Gold Mutual Funds and ETFs offer an easy, pure, and liquid way to own gold without storage hassles or concerns about purity.

A Clear Note for Investors

Equity mutual funds offer growth, while gold offers stability. A well-diversified portfolio should include both. Gold is not a competitor to your equity funds; it is their most reliable partner.

Consider allocating a modest 10-20% of your overall investments to Gold Mutual Funds. This strategic allocation helps manage risk, hedges against inflation, and provides a crucial cushion during market volatility, leading to a more resilient financial future. By doing so, you build a portfolio that can not only thrive in good times but also stand strong in bad times.